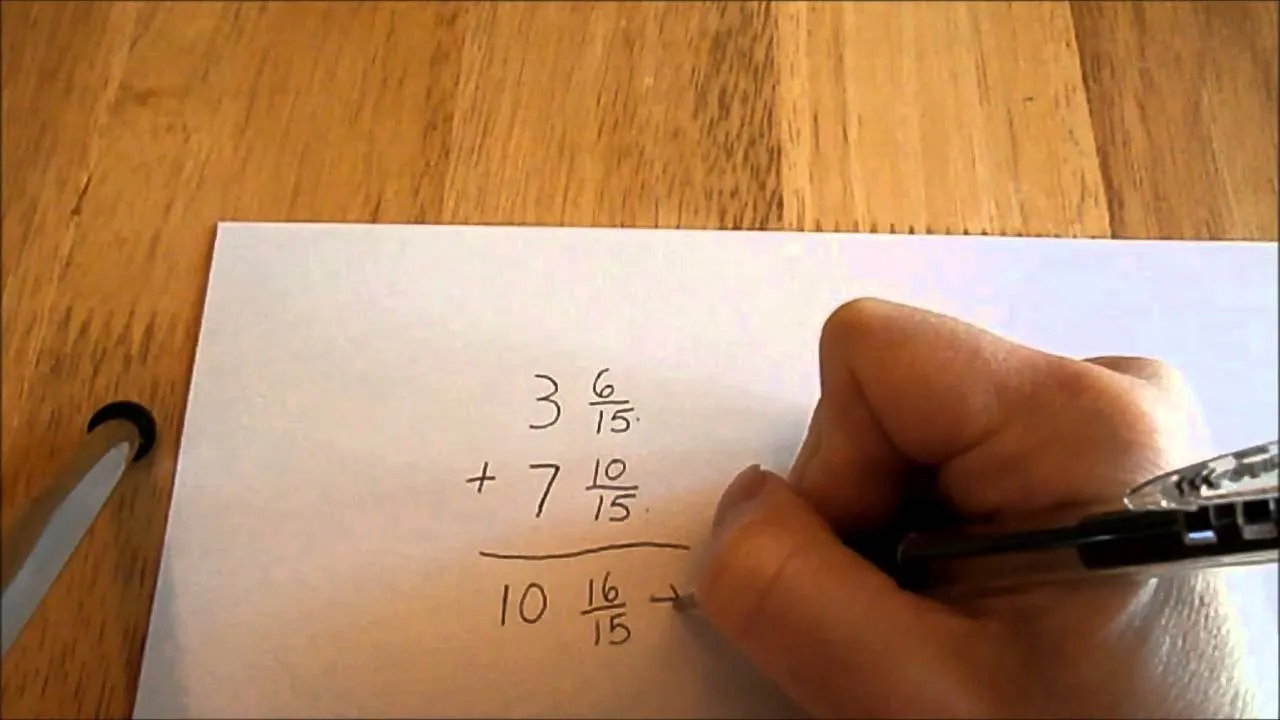

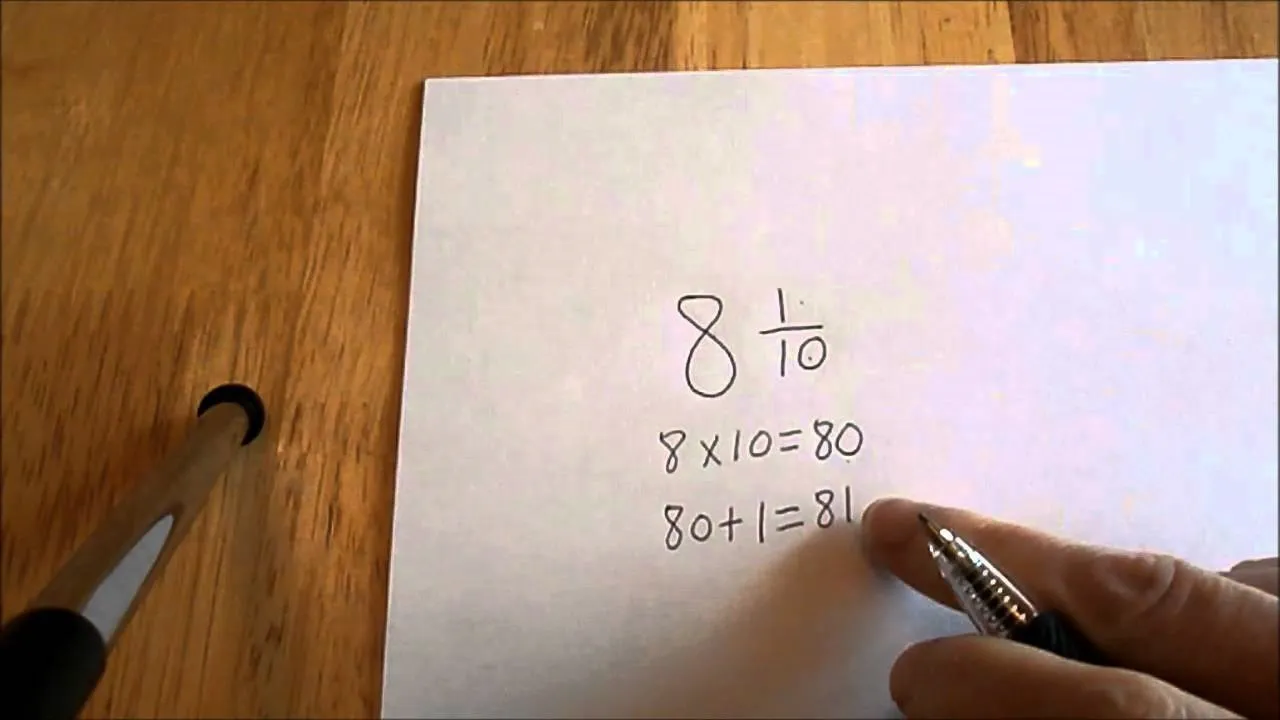

Video describing about how to calculate a sales tax price based on purchase price and sales tax percentage. There is one example which is described as below:

Purchase price is 125.73 and sales tax is 6.5 %. To calculate a sales tax price we need to move sales tax percentage to two decimal points in left and multiply by purchase price. Then we can get price of sales tax which will be added to purchase price so we can get a final price with sales tax. There is other method which is easier as compared to first method. In a second method we have to move two decimal point in left and add 1 and then multiply to purchase price which directly gives final price with sales tax. Then video also describing other examples too. In other example we are taking final value up to two decimal points and add 1 if third decimal is more than 5.

Comments

Be the first, drop a comment!