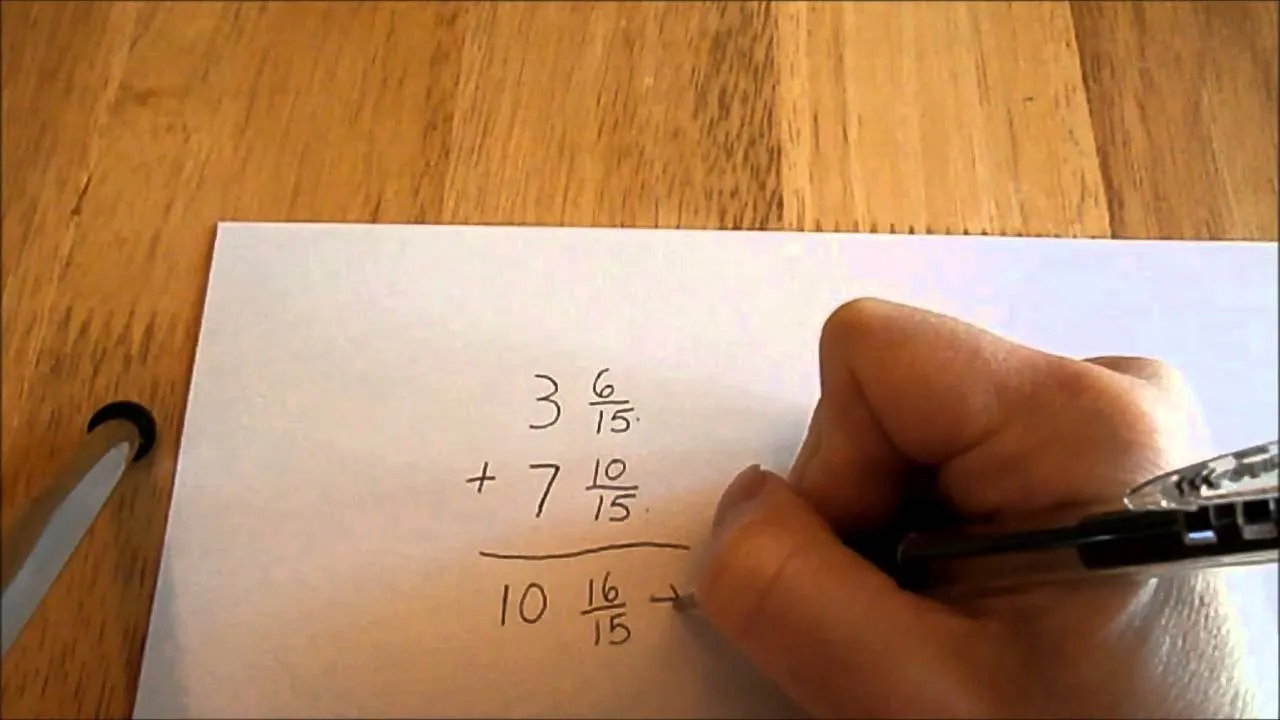

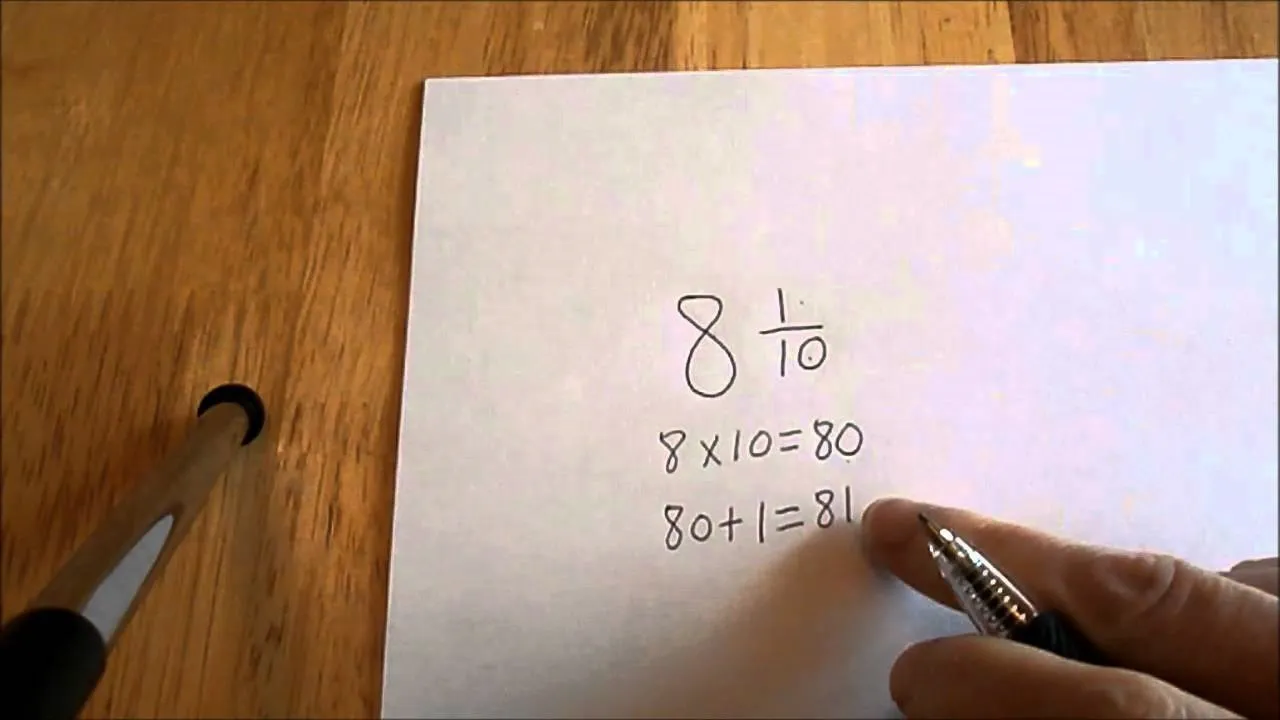

This video is about Annual percentage Rate(APR) and the Effective APR rate.The video begins with an example of a credit card which has a APR rate of 22.9% and daily periodic rate of 0.06274%.You can get the APR rate by multiplying the daily peiodic rate with 365, which in this case will be 0.06274*365 which is equal to 22.9.If you convert the daily periodic rate into decimal values , it will be 0.006274.So for example, if you have 1 dollar in your balance on day 1, on day 2 you will owe 1.0006274 and this well get compounded every day.So if you compute this for a year it will be equal to 1.257 which gives an effective APR rate of 25.7 percent.The video closes by implying that you should not carry balances on your credit card for longer time and if you do, then you would have to pay close attention to the effective APR rate.

Apple's iOS 26 and iPadOS 26 updates are packed with new features, and you can try them before almost everyone else. First, check Gadget Hacks' list of supported iPhone and iPad models, then follow the step-by-step guide to install the iOS/iPadOS 26 beta — no paid developer account required.

Comments

Be the first, drop a comment!